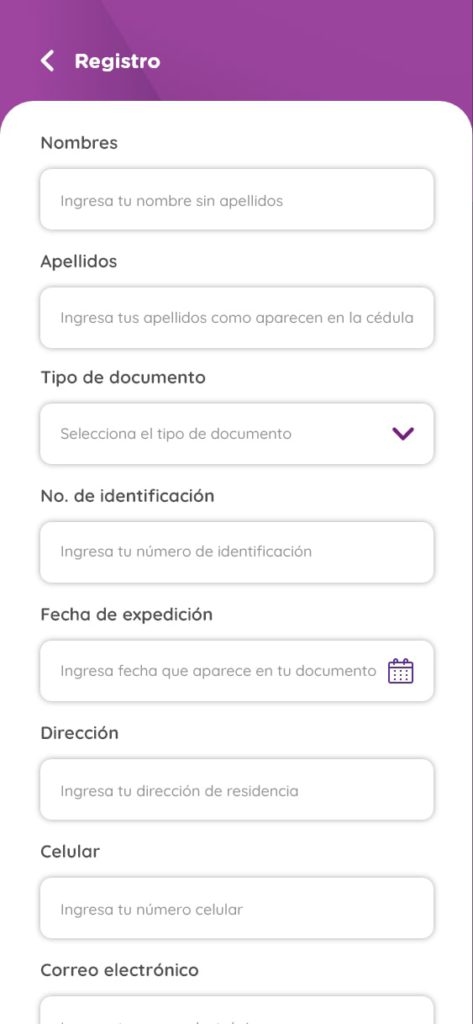

A web/mobile application targeting women-led micro, small, and medium-sized enterprises (mipymes). This fintech app is designed to streamline the process of three loan lines—CrediTech, CrediStart, CrediSchool (focused on technology purchases, raw materials and supplies, and education)—by the Colombian NGO CORFAS to its clients. The aim is to provide a quick, efficient, dynamic, and versatile service. Each credit line has its own form to customize the loan application. The app includes a registration system that collects the necessary information to establish the characteristics of each loan. Users can define the amount they wish to request and the number of installments they want to defer.

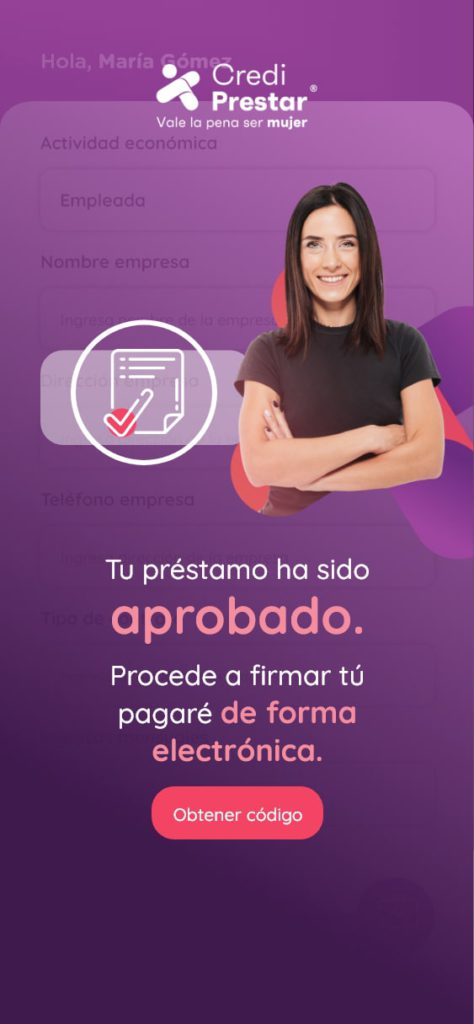

The app simulates the loan, informing the client about fixed costs and projected amounts for each installment. The entire process takes place through this mobile application, starting from the verification of the credit risk profile (Datacrédito query and Crediprestar’s internal algorithm) to the digital signature of the promissory note and the final credit approval.